Trouble Looms as External Force Seizes Control of Banking Regulator’s Boardroom

· A Bank Held Hostage: Consultants Earn More than CBN Governor, 15 Directors Combined

· Cashing Out Amid Economic Ruin: The Ladies Who Feast on CBN’s Coffers

There is a quiet storm sweeping through the grand corridors of Nigeria’s apex bank, an unsettling tremor beneath the stately edifice of financial regulation. It is whispered in the hushed tones of seasoned bureaucrats and murmured through the clenched jaws of discontented directors.

The Central Bank of Nigeria (CBN), once a fortress of prudence and economic stewardship, has been reduced to a vanity box in which a select few, draped in the robes of privilege, dip their hands deep into the coffers of the nation’s financial regulator – so revealed a Premium Times investigative report.

At the center of this grand charade stands Governor Olayemi Cardoso, flanked by two women who have taken the reins of power with a grip so firm that even deputy governors now murmur their names in reluctant reverence.

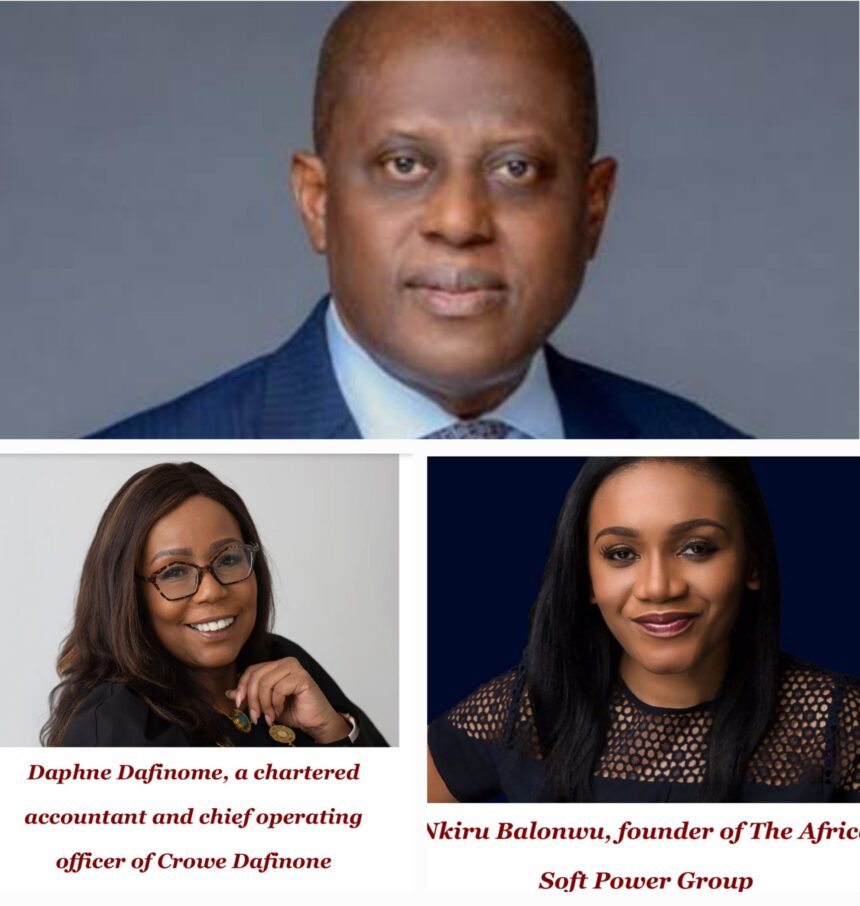

They call them the Cardoso women—Nkiru Balonwu and Daphne Dafinone, the arbiters of an unfolding financial farce.

When Cardoso assumed office on September 22, 2023, he did not walk into the CBN alone. Like shadowed sentinels, Balonwu and Dafinone arrived with him—or shortly after—and never left.

While Nigeria grapples with economic despair, inflation spirals unchecked, and the naira wobbles on the tightrope of devaluation, these women have ensconced themselves within the bank’s highest echelons, drawing power from a wellspring of influence unseen but deeply felt.

Their consultancy roles, nebulous in definition yet firm in compensation, have become a subject of mockery and fury. Ms. Balonwu, a communications specialist, earns an eye-watering N50 million per month—more than Governor Cardoso himself and more than 15 seasoned directors combined. Ms. Dafinone, a chartered accountant, receives a similarly astonishing N35 million monthly.

Their sinecures come with offices on the eleventh floor, where, above the deputy governors below, they issue instructions, sign memos, and shape policy in a way that defies official organograms.

“They are the real power behind the throne,” a senior director grumbled. “Cardoso is just a figurehead. These women run the show.”

A Culture of Impunity and Arbitrary Appointments

The Central Bank of Nigeria is no stranger to scandal, but even at the height of former Governor Godwin Emefiele’s controversies, the institution retained a façade of procedural order. Under Cardoso, that order has crumbled into the dust of arbitrary appointments and opaque dealings.

The appointment of Balonwu as a corporate communication consultant is particularly baffling. The CBN already boasts an extensive communications department helmed by a director, replete with competent professionals tasked with external engagement. Yet, in an audacious act of redundancy, Balonwu now commands a salary that eclipses the very executives responsible for such affairs.

Ms. Dafinone’s consultancy is even more amorphous. Unbound by clear deliverables, she oscillates between various roles, recently overseeing a controversial ‘early exit programme’ designed to push at least 1,000 employees into voluntary retirement—an initiative she spearheaded without the involvement of the bank’s statutory Human Resources Department.

“She bypasses all formal structures,” a CBN insider disclosed to Premium Times. “The women are more powerful than even the deputy governors. They issue directives as though they are in charge of the bank, and Cardoso lets them.”

Consultants Paid Like Moguls, but Where Is the Value?

Nigeria’s economy is wheezing under the weight of economic mismanagement, and the very institution tasked with mitigating this malaise is instead hemorrhaging millions in lavish consultant salaries. With over 29 directors, 170 deputy directors, and more than 400 PhD holders in its employ, why does the CBN need high-priced consultants whose impact remains dubious at best?

“It is an obscene waste,” lamented a senior CBN official. “This is nothing short of an abuse of office. Even Emefiele, with all his excesses, did not operate with this level of impunity.”

The law is explicit on hiring consultants. The Public Procurement Act of 2007 mandates that all government agencies adhere to transparent and competitive processes when engaging external consultants. The law requires public advertisements, clear terms of reference, and rigorous evaluation of candidates. Yet, Cardoso has flouted these procedures, ushering his chosen few into the apex bank without scrutiny, their contracts shrouded in secrecy.

Dafinone’s Legal Troubles: A Question of Integrity

Even more damning is the fact that one of Cardoso’s anointed, Daphne Dafinone, is currently embroiled in a N100 million fraud trial. Accused of duping a real estate buyer in Lagos, Dafinone’s name now graces court dockets alongside allegations of deceit. Despite this, she remains firmly entrenched within the corridors of power, continuing to exert undue influence over the institution.

“How does someone facing fraud charges become a consultant at the nation’s apex bank?” a financial analyst queried. “The optics are terrible. The message it sends to the financial sector is one of rot and impunity.”

The Dangerous Precedent for the Banking Industry

The implications of this unchecked recklessness extend far beyond the Central Bank. The banking industry, already reeling from policy instability and regulatory uncertainty, is watching closely. If the CBN itself—a supposed pillar of economic oversight—is embroiled in this level of internal disorder, what precedent does that set for commercial banks?

“It breeds systemic distrust,” observed a leading economist. “If the institution that should regulate others is enmeshed in opacity and cronyism, it becomes difficult to enforce discipline within the financial system.”

The CBN is not a private fiefdom. It is the custodian of Nigeria’s monetary stability, and the fate of millions hinges on its ability to act with integrity and foresight. Cardoso’s reign has thus far been marred by allegations of favoritism, extravagance, and a dereliction of duty in allowing unelected and unaccountable individuals to wield enormous power.

“This cannot continue unchecked,” declared a veteran banker. “If Cardoso cannot restore credibility to the institution, he must be shown the door.”

As whispers grow into roars and discontent morphs into outrage, Nigeria stands at the precipice of yet another financial scandal. The question remains: will the nation allow its apex bank to be reduced to a vanity box for a select few, or will accountability finally have its day? Only time will tell.