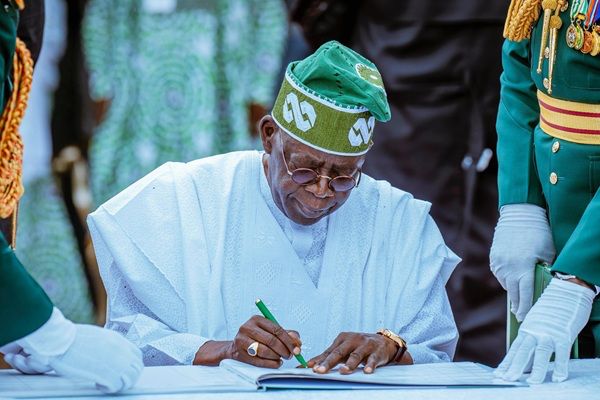

Nigeria’s economic future is under scrutiny following President Bola Tinubu’s request for legislative approval to borrow ₦45 trillion (over $24 billion) in foreign loans. The proposal, part of the 2024–2026 External Borrowing Plan and intended to fund the 2025 budget, has triggered sharp criticism from across the political and economic spectrum.

While the government argues the loans are necessary to address critical development gaps, analysts and civil society groups warn the move could push Nigeria toward a full-blown debt crisis.

Government’s Rationale: Infrastructure and Growth

According to the Tinubu administration, the proposed loan, representing approximately 60% of the 2025 national budget, is targeted at sectors like infrastructure, agriculture, education, healthcare, water supply, and financial reforms. Officials claim it will stimulate job creation, entrepreneurship, food security, and poverty alleviation.

Dr. Tope Fasua, Special Adviser on Economic Matters to the President, defends the borrowing strategy, clarifying that only $1.3 billion of the $21.5 billion ceiling is allocated for 2025. “This is not an immediate withdrawal,” he said. Fasua pointed to improved economic indicators: a drop in Nigeria’s debt-to-GDP ratio from 52% in 2020 to 50% in 2024, and a reduction in debt service-to-revenue from 120% to 64%.

He also stressed Nigeria’s strong repayment track record, including recent settlements with the IMF. With oil revenues underperforming, Fasua emphasised ongoing efforts to broaden revenue sources through property taxes and fiscal reforms at the state level.

Mounting Concerns: “Irresponsible and Perilous”

The proposal, however, has drawn significant backlash. Former Vice President Atiku Abubakar described the loan request as “irresponsible and perilous”, warning that it poses a serious threat to the country’s financial stability.

He noted that public debt had ballooned to ₦144.7 trillion by December 2024, marking a 65.6% increase since President Tinubu assumed office in 2023. Atiku accused the government of running a “loan-dependent economy”, likening its borrowing pattern to a financial pyramid scheme.

Economic projections suggest that if approved, the loan could raise Nigeria’s total public debt to over ₦182 trillion (about $64.65 billion) by 2026, sparking concern about long-term sustainability.

Expert Analysis: Lacking Strategy and Risk Awareness

Professor Simeon Nnah, an economist at Houdegbe North American University, cautioned against approving such a massive loan without clear, detailed plans. He pointed out that debt servicing already takes precedence over essential sectors like healthcare and education. “There is little assurance the funds will be used productively,” he warned.

Ikemesit Effiong, Head of Research at SBM Intelligence, argued that while borrowing is sometimes necessary, Nigeria is taking a huge gamble amid a fragile global economy. He warned about refinancing risks and noted that servicing debt in multiple currencies—including dollars, euros, yen, and pounds—could escalate costs due to volatile exchange rates.

“Even with favorable terms from lenders like the World Bank, the borrowing cost is higher now than in recent years,” Effiong said. He emphasised the importance of ensuring these loans fund projects that generate measurable returns.

Civil Society Voices: Demand for Transparency and Accountability

Seun Onigbinde, co-founder of BudgIT, criticised the government’s lack of transparency. “Why borrow $24 billion when our external debt is already $45.8 billion?” he asked. Onigbinde highlighted the dangers of exchange rate volatility and urged that new loans be tied to foreign exchange–generating projects.

He also questioned government priorities, citing inflated budgets for non-essential items, and called on the National Assembly to consult experts before approval. He acknowledged some reform efforts but insisted that progress in education and healthcare remains slow and underfunded.

Advocacy groups like CISLAC echoed these concerns, stressing that borrowing without clear repayment plans could divert future budgets away from essential services. They cited a history of abandoned or incomplete projects and warned that Nigeria’s growing debt burden could lead to economic stagnation.

The Bigger Picture: A Nation at a Fiscal Crossroads

Nigeria’s external debt has quadrupled since 2015, yet citizens see few tangible improvements. The naira continues to fluctuate, and oil revenue—a primary income source—remains unreliable. The concern now is not just about how much Nigeria owes, but whether the borrowed funds are genuinely advancing national development.

While the Tinubu administration emphasises growth, economic diversification, and fiscal discipline, its critics argue that rhetoric must be backed by results. Without transparency, measurable impact, and spending reforms, the proposed borrowing risks deepening Nigeria’s economic vulnerability.

Recommended Solutions

To avoid long-term debt distress, Nigeria should consider the following:

Enforce Strict Oversight – The National Assembly must demand detailed project plans and timelines for every dollar borrowed.

Prioritise Productive Spending – Funds should target infrastructure, education, and health sectors that offer clear social and economic returns.

Reduce Recurrent Expenditures – Curb wasteful government spending and redirect funds to capital projects.

Boost Domestic Revenue – Expand the tax base through effective property tax systems and digital revenue collection reforms.

Improve Transparency and Public Engagement – Regular public updates and civil society involvement can build trust and deter misuse.

Set Debt Limits and Triggers – Create legal safeguards that prevent excessive borrowing without performance-based results.