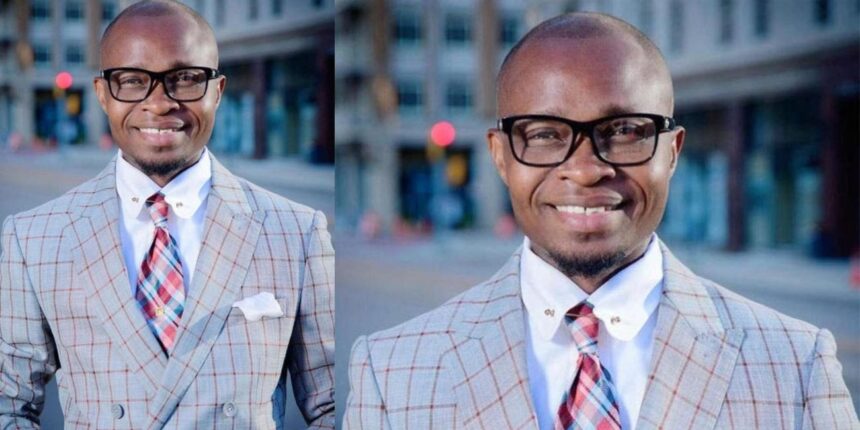

The United States Securities and Exchange Commission (SEC) has filed a lawsuit against a Nigerian man, Joseph Nantomah, and a number of firms over alleged $1.9million fraud.

The SEC’s complaint, submitted at Wisconsin Eastern District Court on August 1, 2025, concerns a real estate-related offering fraud allegedly perpetrated by Nantomah through three Wisconsin limited liability companies he owned and controlled.

The firms are; Investors Capital LLC, Global Investors Capital LLC, and High Income Performance Partners LLC.

The complaint alleges that, from approximately May 2020 through at least January 2024 (the “Relevant Time Period”), the defendants solicited investors by promising to purchase, fix, and flip real estate for profit.

The defendants allegedly collectively raised at least $1.9million from at least 30 investors throughout the United States.

Unbeknownst to investors, many of whom were members of the Nigerian-American community, Nantomah allegedly misused their money by spending at least 80% of it on himself and his other ventures, and not on the promised real estate transactions.

Nantomah held himself out as an “Incredibly Successful entrepreneur” who amassed a multi-million dollar real estate portfolio after emigrating from Africa to Wisconsin in 2016 “with just $4700,” to become a “notable and sought after millionaire investor” who serves as a speaker, life coach, mentor, consultant, and philanthropist.

Nantomah made these and similar representations on his website, on social media sites, during presentations to potential investors, and during financial coaching seminars.

Likewise, Nantomah’s claims on his website in 2024 that he owned “real estate assets currently valued at over $23 million,” were also untrue.

According to public records searches, during the Relevant Time Period, Nantomah and the entities he controlled—including Defendants Investors Capital, Global Investors Capital, and High Income Performance Partners (together, the “Entity Defendants,”) – owned only 11 properties with a collective value of approximately $1million.

Nantomah further allegedly enticed investors with promises of lucrative returns on investments (or “ROI”) in a year or less.

Meanwhile, the defendants have not paid most investors as promised in the written and verbal investment agreements.

The SEC accuses the defendants of violations of the federal securities laws, namely Sections 5(a), 5(c), and 17(a) of the Securities Act of 1933 and Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder.

The regulator claims that there is a reasonable likelihood that, unless restrained and enjoined, Defendants will continue to violate these federal securities laws.

Accordingly, the SEC seeks a judgment against the defendants that: (a) imposes permanent injunctive relief, including prohibiting Nantomah from again offering or selling securities; (b) orders disgorgement of ill-gotten gains plus prejudgment interest; and (c) imposes civil monetary penalties.

[8/5, 5:31 PM] +234 802 396 2289: On the 13th of May 2025, the court sat to decide on the damages to be awarded in the case of Mr. Alfred Olusanya and Olayinka Nnochiri.

The plaintiffs appeared virtually but were represented by their attorney who was present in court.

The defendant who also appeared via Zoom was not represented.

The court had earlier granted a default judgment against Mr. Nantoma and his company, Investors capital LLC. The court stated that the plaintiffs did, in fact, enter into a Ponzi Scheme agreement with Mr. Joseph Nantoma, which was breached.

The plaintiff, Mr. Alfred Olusanya, invested $55,000 into a ‘fix and flip’ real estate investment with the defendant and expected a return of $70,000 from the defendant’s real estate business, which never happened. So also, is Ms. Nnochiri who invested $50,000 and expected the return of $65,000. The court found that there was a breach of contract and granted both parties statutory 5% interest per year on their investment.

Mr. Joseph Nantomah, however, stated that he was transparent about the procedures relating to his investment.

He said that when he claimed that he has a portfolio of $21 million, it was a combination of the assets of those business partners that he was working with.

He said that the plaintiff with their attorney used manipulative words to present his words in their favour.

He claimed he never approached any of the investors and he never stole from them.

Mr. Nantomah in his words stated that “they approached me because they saw I was having success”. He said all of his investors attended his classes and trainings and that they gave good reviews during his classes. L

In response to Mr. Nantomah’s assertion, the plaintiff attorney reiterated the fact that this isn’t a business deal that went wrong, but a case of theft.

She stated that her client relied on Mr. Nantomah’s false and fraudulent misrepresentations of his real estate portfolio, the self-acclaimed success in real estate and living the American dream.

She said that her clients later realised that it was all lies. They realised that he did not have a massive real estate portfolio, he is not a millionaire, and he is not investing their money as promised.

The court, after listening to both parties, granted actual damages to plaintiffs to cover the court cost and their attorney’s fees.

The court reinforced the fact that Mr. Nantomah’s dealings with the plaintiffs were nothing but a Ponzi scheme.

The court stated that there were no actual properties that were flipped and sold at a loss in this case, as the defendant had claimed.

The court described the situation as a case of taking money from the plaintiffs and running with it. The court went further to say that Mr. Nantomah’s definite intention was to take the money from the plaintiffs and to convert the same to his own use.

As a result, the court granted both plaintiffs exemplary damage, each in the amount of $25,000 for their civil theft claim. In the deceptive trade practices claim, the court also granted punitive damages and awarded both plaintiffs the sum of $25,000, each.

The defendant’s conduct was said by the court to be malicious and intentional.

The court concluded that Mr. Nantomah cannot represent his company, Investor Capital LLC, being a legal entity on its own.

The court went further to say that when Investor Capital, LLC, is represented in court, the plaintiffs reserve the right to file damages claims against the company, based on the previous default judgment against Investor Capital LLC.