Following Imisi’s historic win in the just-concluded Big Brother Naija reality TV show, a Nigerian X user has sparked conversation after breaking down the potential tax implications of such a large cash prize.

Recall that Imisi Ayanwale has emerged the winner of the Big Brother Naija season 10, winning a 150 million cash prize alongside other gifts.

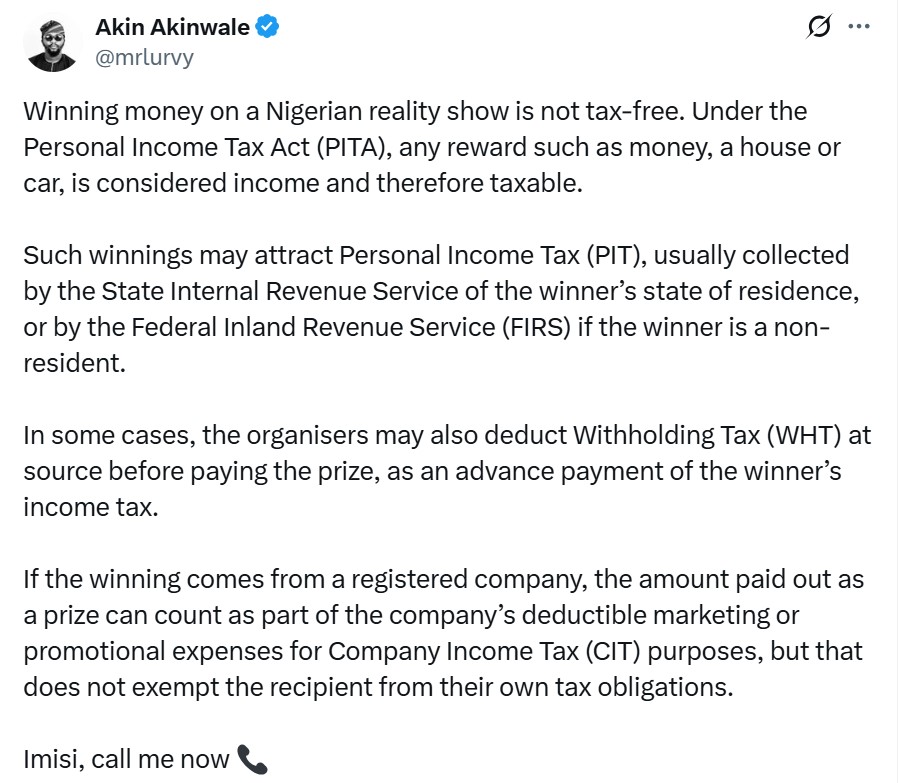

In a detailed post, the user explained that winnings from Nigerian reality shows are not tax-free, referencing the Personal Income Tax Act (PITA).

According to the law, any form of reward, whether money, a house, or a car, is considered income and is therefore subject to taxation.

He noted that the Personal Income Tax (PIT) is typically collected by the State Internal Revenue Service in the winner’s state of residence.

If the winner is not a resident in Nigeria, then the Federal Inland Revenue Service (FIRS) may be responsible for collecting the tax.

In some cases, Withholding Tax (WHT) may also be deducted at source by the organizers before the prize is disbursed serving as an advance on the winner’s expected income tax.

The user added that while the company giving out the prize may classify it as a deductible marketing or promotional expense for their own corporate taxes, this does not exempt the winner from their individual tax obligations.

The post which was light-hearted has generated mixed reactions from internet users and fans of the reality TV show.

See tweet below,