A Nigerian influencer known as Raye has taken to social media to cry out after being charged ₦487,500 in Value Added Tax (VAT) on purchases worth ₦6.5 million.

The outcry comes amid the Federal Government of Nigeria’s new tax laws, which took effect on January 1, 2026, aimed at increasing transparency and tightening VAT collection on high-value transactions.

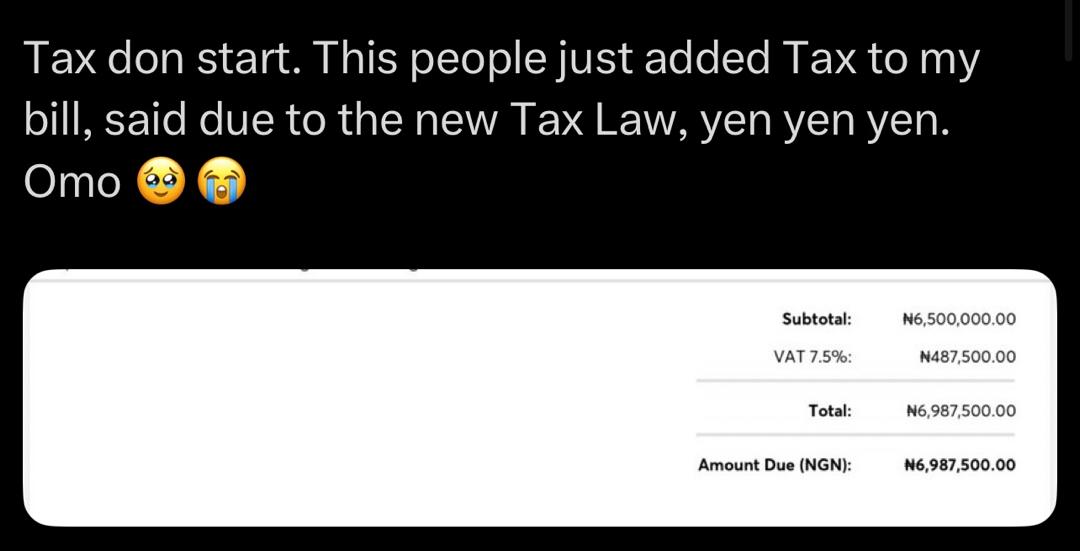

Taking to her X (formerly Twitter), the influencer shared a screenshot of the VAT charges, expressing frustration over the new tax law.

In her words, she said:

“Tax don start. These people just added tax to my bill; they said it’s due to the new tax law.”

The post quickly sparked reactions across social media, with Nigerians divided in their opinions.

While some argued that stricter tax enforcement is necessary to boost government revenue and development, others sympathised with influencers and small business owners who are already struggling under rising costs.

Many users noted that the impact of the new tax regime could be especially hard on individuals who earn through online platforms, content creation, and digital businesses.

Reactions poured in online. One commentator wrote, “God abeg oo, this year go tough pass last year. How much tax be this?” Another added, “Tax for a country that isn’t functioning well. It is well.”

As VAT enforcement becomes stricter in 2026, more Nigerians are beginning to feel the pinch.

Check post below…