.Reduces interest rate to 10%

The Federal High Court, Lagos has ordered Mrs Udokanma Okonjo, Chief Executive Officer of Fine & Country West Africa and sister-in-law to World Health Organisation (WHO) Director-General Dr Ngozi Okonjo-Iweala, to pay Providus Bank Plc., the sum of $97,982.19, affirming that she fully utilised an overdraft facility linked to her World Elite Card.

The suit marked FHC/L/CS/901/2025 was filed by Providus Bank and centred on whether the defendant accepted and utilised an overdraft facility under the account-opening terms and whether the bank was entitled to recover the outstanding balance with interest.

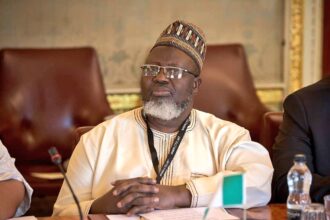

Delivering judgment, Justice Ambrose Lewis-Allagoa held that Mrs Okonjo voluntarily executed her Account Opening Form, agreeing to Clauses 12 and 23A–B, which authorised the bank to grant and recover overdrafts with interest.

Her repeated withdrawals in excess of her account balance, the Court said, confirmed full acceptance and use of the facility.

The Court upheld the bank’s claim of indebtedness but described the 26 per cent interest rate sought as excessive, reducing it to 10 per cent yearly until the debt is fully liquidated.

Justice Lewis-Allagoa observed that while banks are entitled to charge interest on overdrafts, “courts will intervene where rates become unnecessarily exorbitant.”

In reaching his conclusions, the Judge agreed with the submissions of counsel to Providus Bank, Mitchel A. Aribisala, that the defendant’s consistent use of the World Elite Card and failure to dispute her account statements amounted to an acknowledgement of the overdraft facility and its attendant obligations.

A related application by Fine & Country International Realty (West Africa) Ltd, seeking to lift a post-no-debit (PND) restriction on its account linked to the defendant’s Bank Verification Number (BVN), was dismissed.

Relying on the UK Supreme Court’s decision in JSC BTA Bank v. Ablyazov [2015] UKSC 64, the Court held that even where assets are not legally or beneficially owned by a debtor, they may still be frozen if the debtor exercises direct or indirect control over them.

Justice Lewis-Allagoa reasoned that Mrs Okonjo, as CEO of Fine & Country, exercised control over the company’s funds; hence, the freezing order was valid and constitutional.